Data-driven breakdown of the Steam market, 2021–2025

Every year, tens of thousands of developers come to Steam hoping their game will “find an audience.” The platform seems democratic: publish a game, pay the fee—and you’re right next to the hits. But are they really doing that well? The data says that in reality, Steam is a brutally competitive market for players’ attention, where either you attract players at launch, or, most likely, oblivion awaits you…

Together with Igor Kamerzan, a localization engineer at Inlingo, we present the results of an analysis of Steam data for 2021–2025 (≈65,000 games).

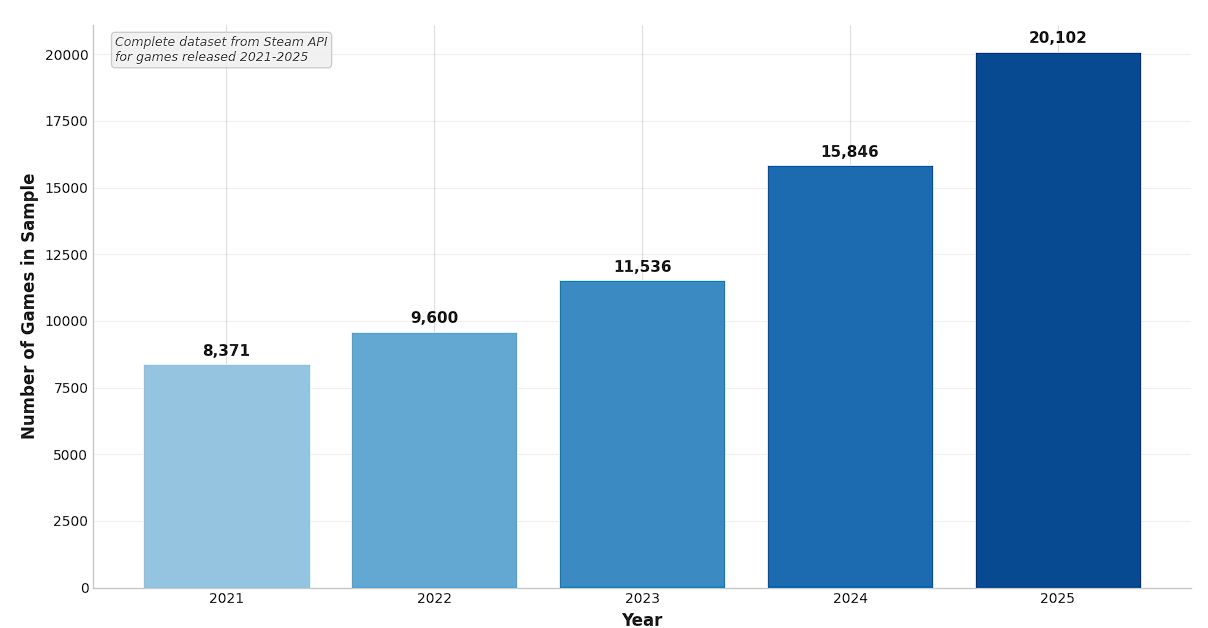

A major increase in volume

So, according to the dataset, from 2021 to 2025 the number of annual releases on Steam more than doubled (from 8,371 to 20,102 titles). The overall growth was +140.1%

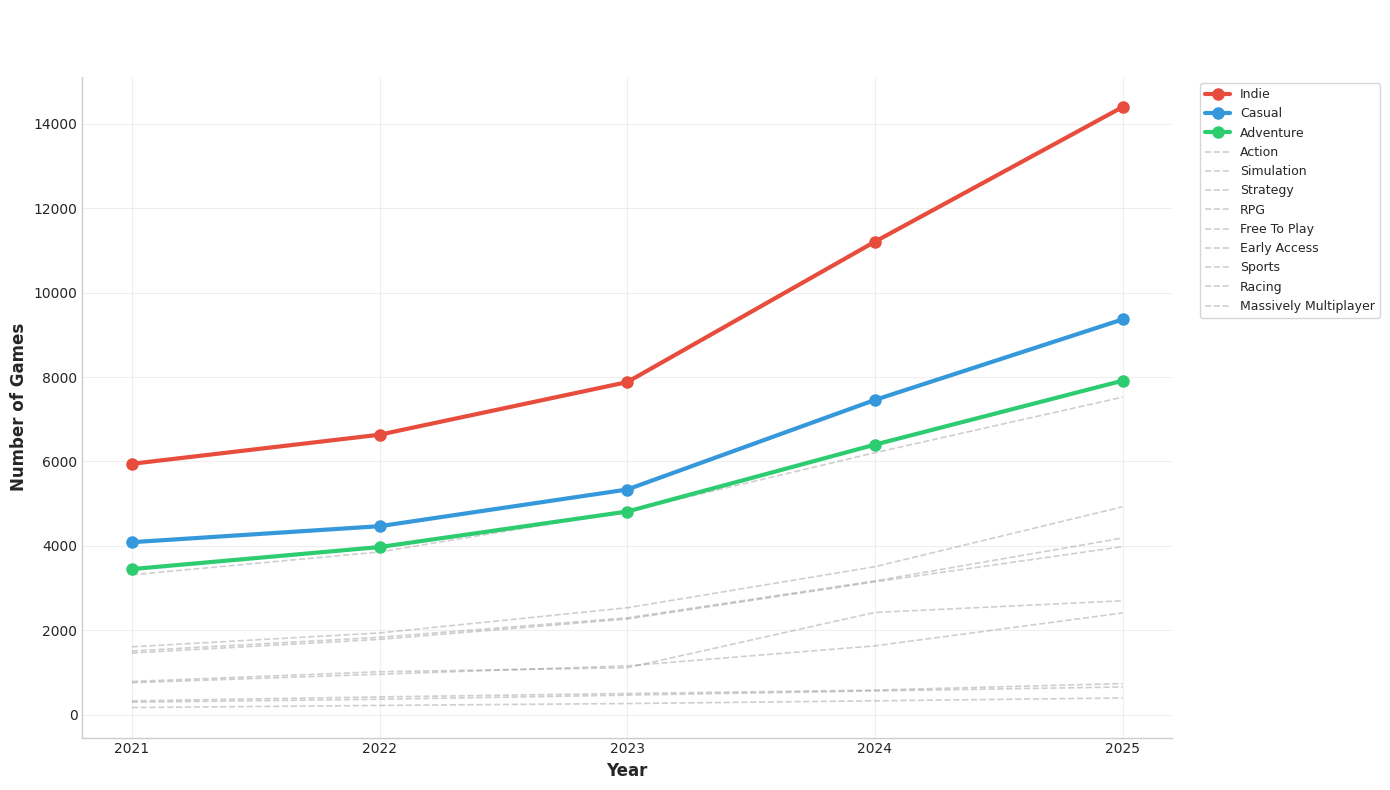

Most of them are in the indie segment. This suggests that the Steam market is genuinely accessible for developers without big names. They are the driving force behind the growth of supply on Steam.

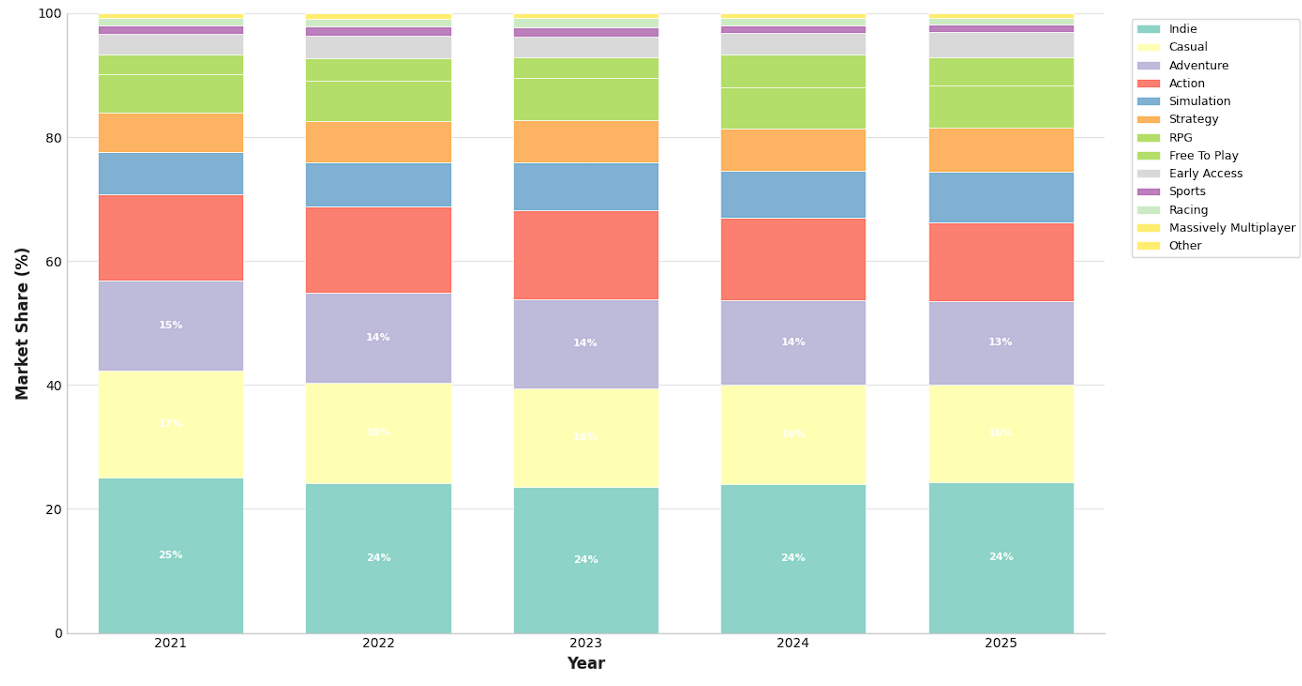

Despite the significant growth in the total number of games released over the past 5 years, the genre mix remains the same—the market is highly predictable. Popular genres (Indie, Casual, Adventure) continue to dominate, accounting for the bulk of releases, while niche categories maintain their small but stable shares.

A typical game on Steam gets zero player reactions

Another interesting metric included in the dataset is the number of recommendations (Number of user recommendations). Recommendations are left by users themselves by clicking “Recommend” on the page of a specific title. If we divide the total number of recommendations for games released in 2021–2025 by the number of titles that received them, we get the average—362 recommendations per game. However, if we look at the market more granularly, we’ll see that the top titles have captured most of the recommendations.

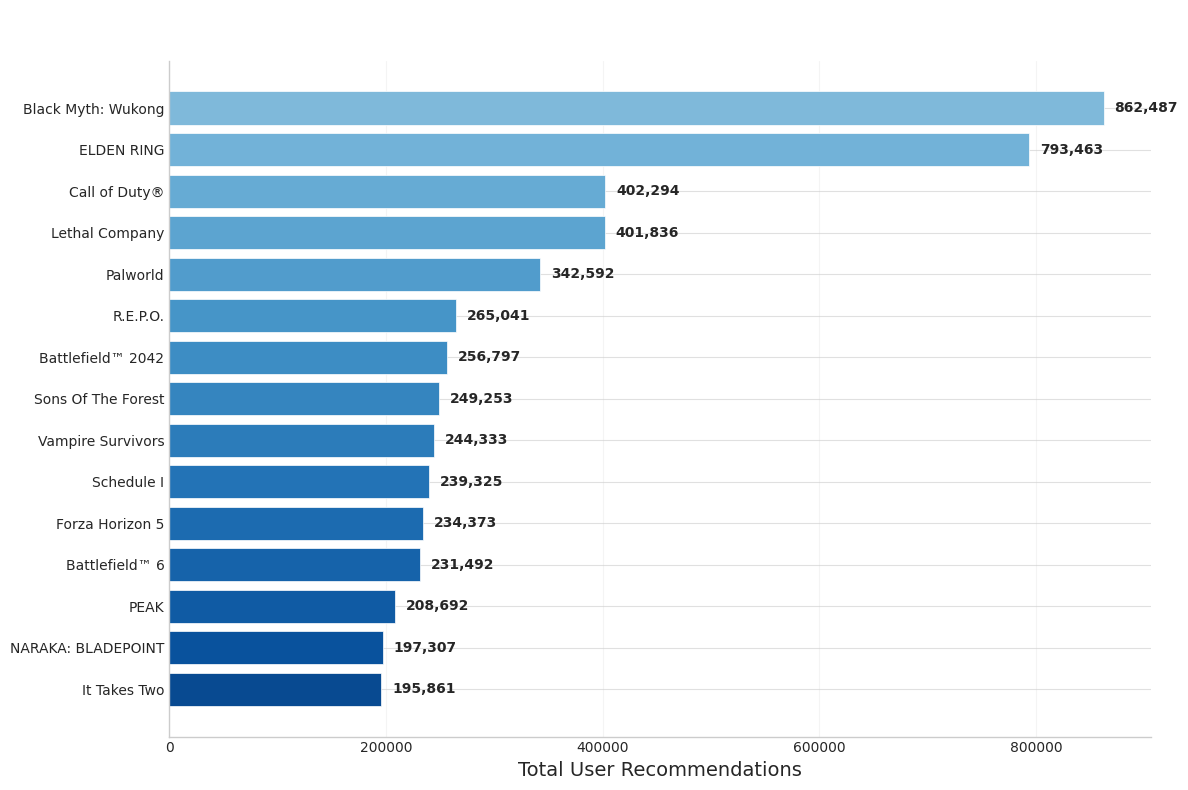

As of November 2025, Black Myth: Wukong had almost 900,000 recommendations. That is an incredible success. It is followed by ELDEN RING and Call of Duty. The top games by recommendations are all recognizable titles. But what if we calculate not the mean, but the median value—which is more robust to outliers.

The median number of user recommendations according to the dataset presented is 0. And this holds true across all months, all genres, and the entire 2021–2025 period. This means that a typical release goes unnoticed.

Averages can be misleading: a handful of hits pull the entire statistic upward. In reality, there are no “average” games on Steam—only visible and invisible ones. And for free-to-play games, the situation is even worse. But let’s take a look at how the total number of recommendations is distributed across all games.

Attention concentration: a market of Titans

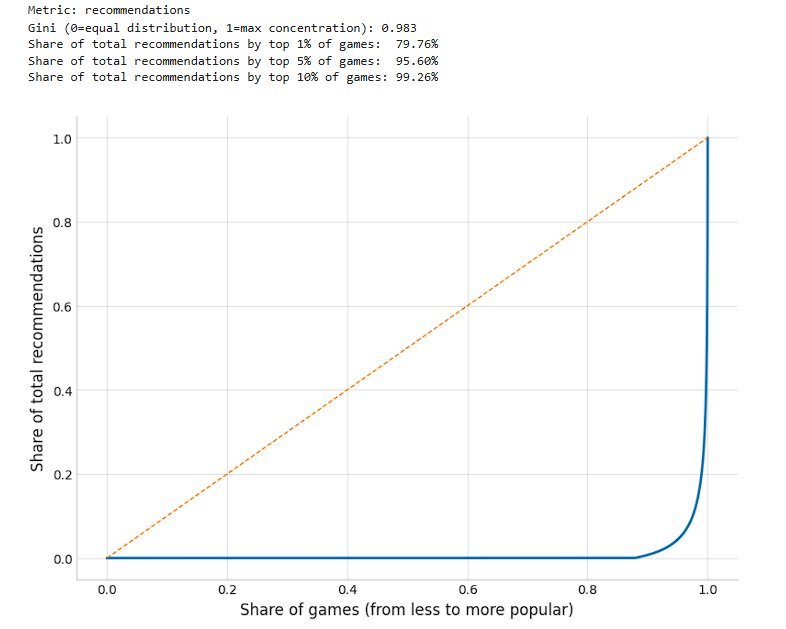

When we look at the distribution of recommendations, the picture becomes even harsher. 87.5% of games on Steam do not receive a single user recommendation. Which means that only 12.5% of titles get any feedback.

A Gini coefficient of 0.983 is practically at the maximum (1.0). This means that the distribution of recommendations across games is almost maximally unequal. Only a handful of games receive the overwhelming majority of user “attention,” while a huge share of games remain virtually unnoticed. In market terms, this is a super-hit, “star-driven” market.

The top 1% of games accumulates ~80% of all recommendations. The top 10% of games collects ~99.3% of all recommendations. Success on the platform is concentrated in an incredibly narrow group of winners. The remaining 90% of games share just 0.7% of the total volume of recommendations. This creates a “superstar” effect, where popularity concentrates around a small number of well-known products.

Steam is a market at a phase transition

We’ll also look at the dynamics of a game’s launch. If we measure the speed at which recommendations are accumulated from the moment of release, the market behaves in a binary way: a fast start gives a high chance of success, while a slow one almost certainly leads to oblivion. That is, the game needs to “switch on” immediately.

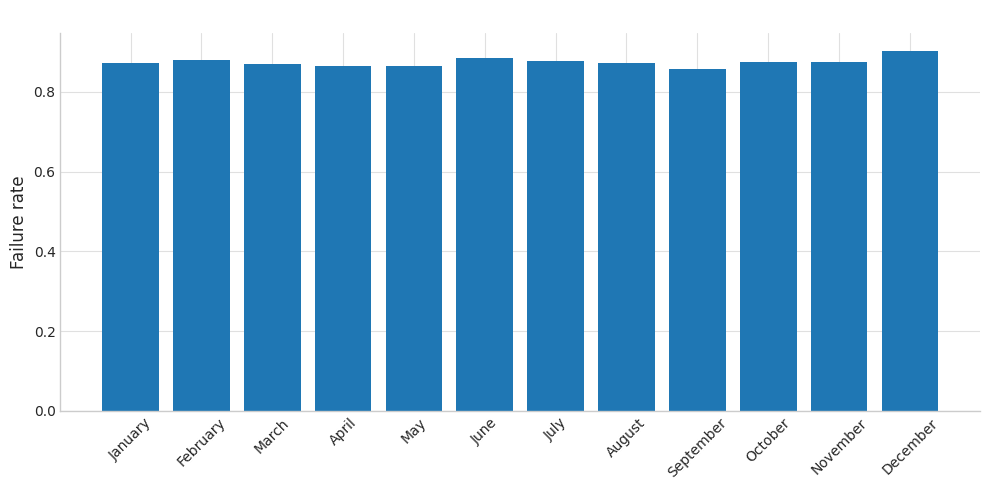

Let’s assume that if a game has collected more than 20 user recommendations, this will mean that it has achieved commercial success on Steam. We can look at how such success depends on the release month.

The month-to-month variation is minor. Thus, for most games there is no “lucky month” to release. The median number of recommendations is zero in any month, and the share of “dead” releases is also stable. Seasonality may affect hits, but it doesn’t save ordinary games.

The only thing worth noting is that if a game is released in December, its chances of success are even lower. This is likely influenced by major releases, discount competition, and some other factors.

Minimum viable start (MVS)

According to the dataset presented, if a game doesn’t get 10 recommendations in the first 30–60 days, its chance of making it into the top 10% is less than 1%. And if it doesn’t get them in the first 90 days, statistically it is almost guaranteed to remain unnoticed. You can’t “build up momentum” for a typical game over time. If the launch fails, patches and updates won’t change the overall trajectory. Most likely, Steam’s algorithms amplify early momentum rather than later attempts.

In this regard, it is very important for Steam developers to plan their release from the standpoint of attracting users. Trying to enter the market and then hoping for the algorithms is a losing strategy. We recommend putting as much effort as possible into creating launch momentum at the moment of release: bring in the first 50–100 players, get the first 10–15 recommendations.

Final conclusions

The Steam market is heavily concentrated around hits, and a game’s fate is usually decided in the initial period after release. Therefore, we recommend that Steam game developers ensure a minimum viable launch even before release; treat it as the culmination of marketing and immediately try to attract as much audience as possible across different locations.